The future of AI, Automation, and Accounting

In 2013, a study from Oxford University came out that concluded there was a 98% chance the jobs of bookkeepers and accountants will be automated.

At the time, this possibility seemed like a decades-off dream.

But as AI has advanced over the past 6 months, winds seem to be shifting.

I’ve used a lot of different solutions, taken a lot of different demos, and been left with the feeling that while these technologies are helpful, they’re not replacing any jobs.

Let me explain.

Let’s use Quickbooks as an example.

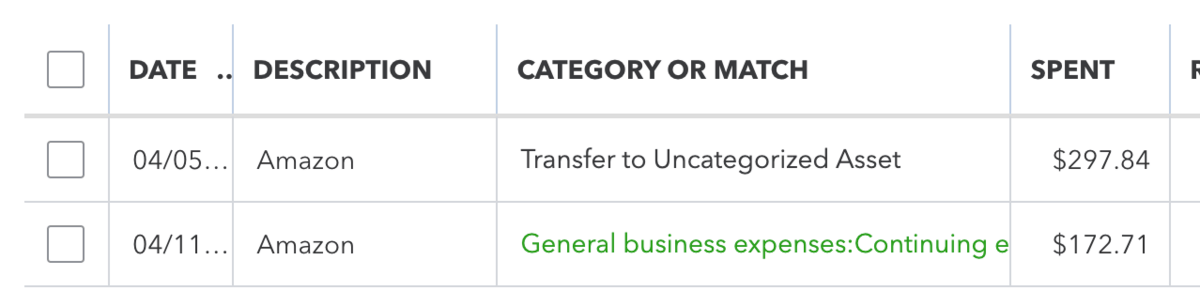

Anytime I buy the next item at Amazon, it wants to code it how it was previously coded.

It’s using a simple rules engine that says “code it off the last transaction.”

While this is helpful some of the time, it’s frustrating more often than not.

Accounts Payable platforms use OCR to pull vendors, amounts, and dates from invoices. When you combine with vendor-based rules engines, these platforms can get the coding right much of the time.

But, it’s still just wrong enough that someone has to interact with every transaction.

With APIs and integrations between platforms, companies can now pick the ideal platform for what they’re trying to accomplish and use these workflows to get the best of all words.

They might choose Quickbooks for Accounting, Fathom for Reporting, Brex for Employee Expense Management, Gusto/Rippling for Payroll & HR.

While most of these make your life significantly easier, you’re still having to extract the valuable parts of each of these sources, leaving you with a mishmash of solutions that don’t talk well together.

But with the introduction of AI, this is slowly changing.

Brex has partnered with OpenAI to create chatbots that make interacting with the data, and extracting insights is easier than previously imaginable.